SensingSG Q2 2025: Tariffs, Trust, and Turning Points

SensingSG’s latest wave captures a nation that’s feeling secure at home but sceptical abroad.

The latest data from Blackbox’s SensingSG platform (Q2 2025) suggests that confidence in Singapore’s domestic direction is firming in the wake of a decisive GE2025 result — and with National Day around the corner, optimism about both governance and finances is holding steady. But this positive outlook does not extend to international affairs. Singaporeans are increasingly uneasy about developments overseas, and public sentiment towards the United States, in particular, is deteriorating sharply.

[All figures in brackets [e.g. (+2pts)] denote the percentage change from last quarter, Q1 2025]

Trump’s Tariffs Shift Public Opinion — and Spending

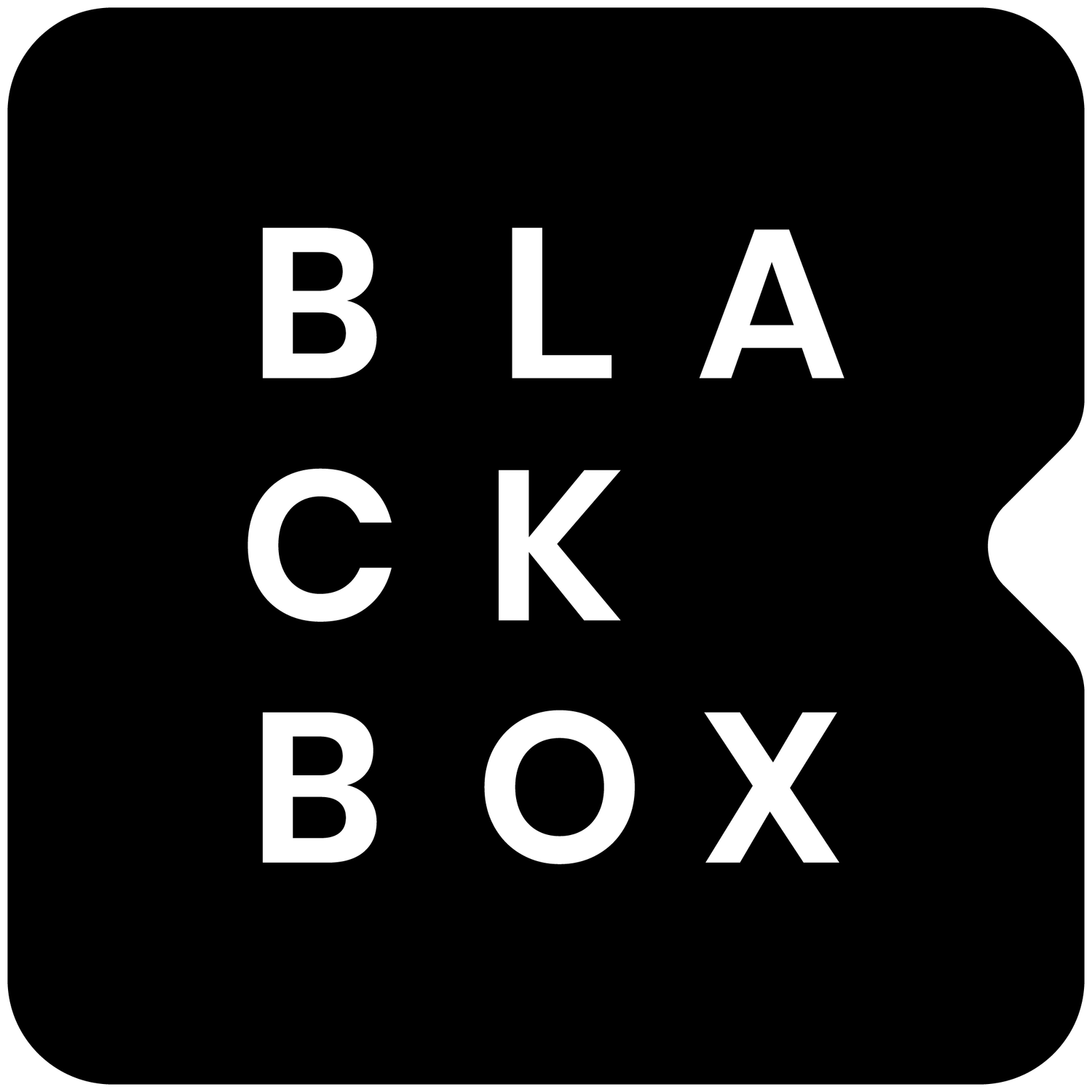

Half of all Singaporeans (49%) now say that Donald Trump’s latest tariffs have worsened their opinion of the U.S. President. That’s a marked change from when he first took office, when 69% told us they viewed his return to office positively. The data suggests that Trump’s second-term trade policies are rapidly undermining that goodwill.

What’s more striking is how this disapproval is spilling over into broader perceptions:

33% say they now think worse of the American people as a whole

35% hold lower opinions of U.S. companies

35% feel similarly about American goods and services

And these are not just abstract attitudes. The impact is showing up in real-world behaviour.

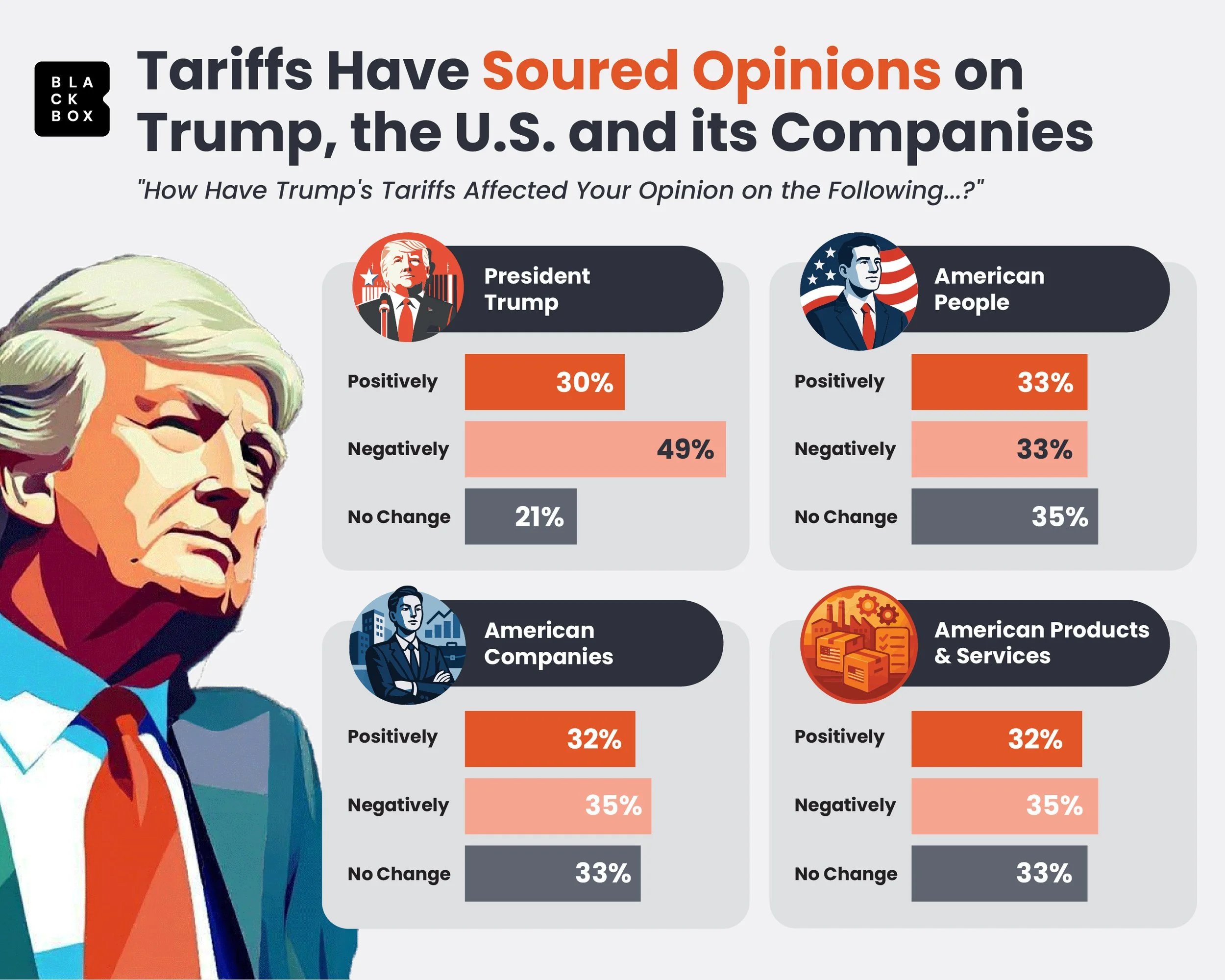

One in three Singaporeans say they have reduced spending on American products over the past six months — a higher pullback than for any other country.

An additional 44% say they plan to avoid American goods moving forward, and 38% are considering it.

Only 18% say they’ll continue purchasing at the same rate.

The top American categories under most threat of diminished Singaporean spending? Electronics and tech, fashion, and fast food.

From Cheap to Chic: The Rise of Chinese Brands in Singapore

If the fallout from Trump’s tariffs is prompting many Singaporeans to rethink their relationship with American products, with 50% of males and 38% of females in Singapore intending on reducing their spending on them, it’s also opening the door for Chinese brands to step in — and step up.

While American household names are still preferred by Singaporeans in brand-on-brand matchups — Instagram over TikTok, iPhone over Huawei, Starbucks over Chagee — this trend largely reverses when comparing product categories as a whole.

This quarter’s SensingSG data shows that across entire categories, Chinese brands are increasingly preferred, broadly speaking. Singaporeans now favour Chinese brands over American ones when shopping for:

Motor vehicles: 34% to 28%

Groceries: 36% to 32%

Household appliances: 39% to 30%

Lifestyle experiences: 38% to 31%

Snacks and Convenience food: 37% to 32%

And this is far from just a pricing story. As we noted in our recent China Chic deep dive, Chinese brands are no longer seen as low-cost alternatives, but rather as credible, competitive, and increasingly design-forward players in their own right. They’re not just catching up, they’re forging ahead. In fact, in the first 4 months of 2025, Chinese EV giant, BYD, dethroned the long standing industry mainstay, Toyota, as the best-selling car brand in Singapore, marking not just a win for BYD, but a symbolic breakthrough for Chinese brands in general, challenging outdated assumptions and redefining what “Made in China” means to consumers.

Singapore may not be a strategic market in terms of global sales volumes, but the shift in sentiment here is worth noting. When politics influence perceptions, and perceptions influence purchases, even small markets can become bellwethers. The message is clear: consumer trust is fragile — and increasingly borderless.

A Confident Mood at Home, Backed by Stronger Fundamentals

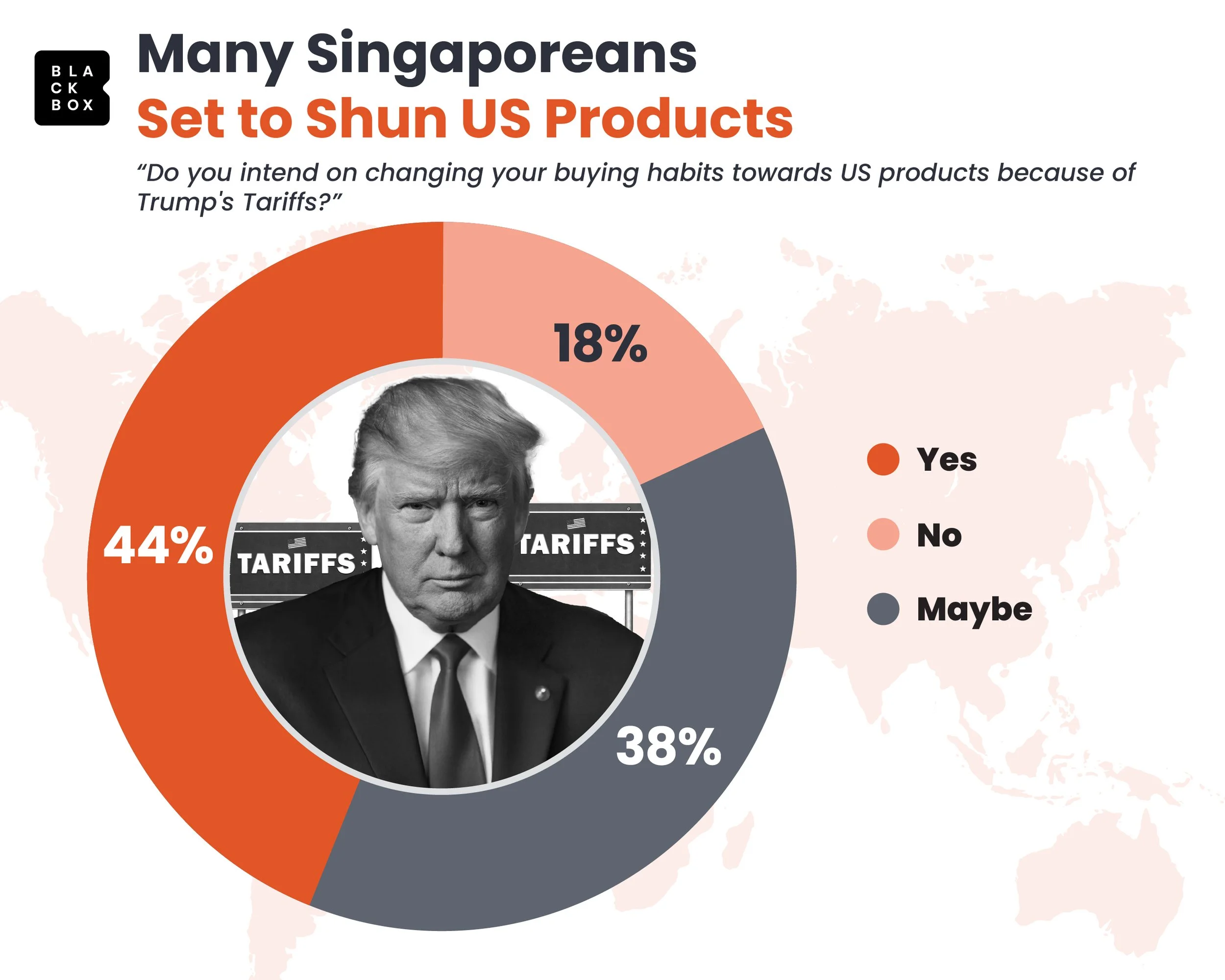

Domestically, the mood is more settled. The combination of a strong election mandate for the PAP, macroeconomic improvements, and the symbolic lead-up to Singapore’s 60th National Day has contributed to a sense of stability.

90% of Singaporeans say the country is heading in the right direction (+2pts) - the highest proportion since we started tracking this metric almost 2 years ago

Youth are particularly upbeat: 92% of those under 30 agree Singapore is on the right track

89% are satisfied with how things are in Singapore today (+4pts)

The Good Governance Meter - an aggregated measure of satisfaction from rankings of government performance on 26 core community issues - holds steady at 71%, a slight decline (-2pts) from last quarter

Importantly, cost of living remains the top concern, and simultaneously the weakest area of perceived government performance, with just 54% (+2pts) of Singaporeans being satisfied with the government’s performance, although it is a significant improvement from the 35% satisfaction rate in Q2 2024. However, the issue appears to be losing some of its bite — it remains the most important issue to just 36% of Singaporeans this quarter (-4pts), compared to 49% at the same time last year — a sign that financial support measures like GST, CDC and SG60 vouchers, as well as a cooling global inflationary environment may be starting to register.

Satisfaction with the government’s performance on housing affordability — historically also one of the most negatively viewed policy areas — remained steady at 58% (-1pt). This reflects a consistent improvement, up from 46% in Q2 2024 and suggests that recent government interventions such as increased CPF housing grants, a reduction in median BTO flat waiting times, and a round of property cooling measures introduced in August 2024 have begun to resonate positively with Singaporeans.

Meanwhile, public confidence in other key areas remains strong. Satisfaction levels are highest in defence and national security at 84%, followed closely by race relations, education, and digital government services, all at 80%. These figures underscore the importance of continued government focus and commitment in these areas.

Economic Confidence: Up Across the Board

Confidence is not just political — it’s financial. Both national and personal economic indicators show marked improvement from the previous quarter.

National Economy:

86% rate current conditions as “quite good” or better (+2pts)

57% expect further improvement in the next 12 months (+5pts)

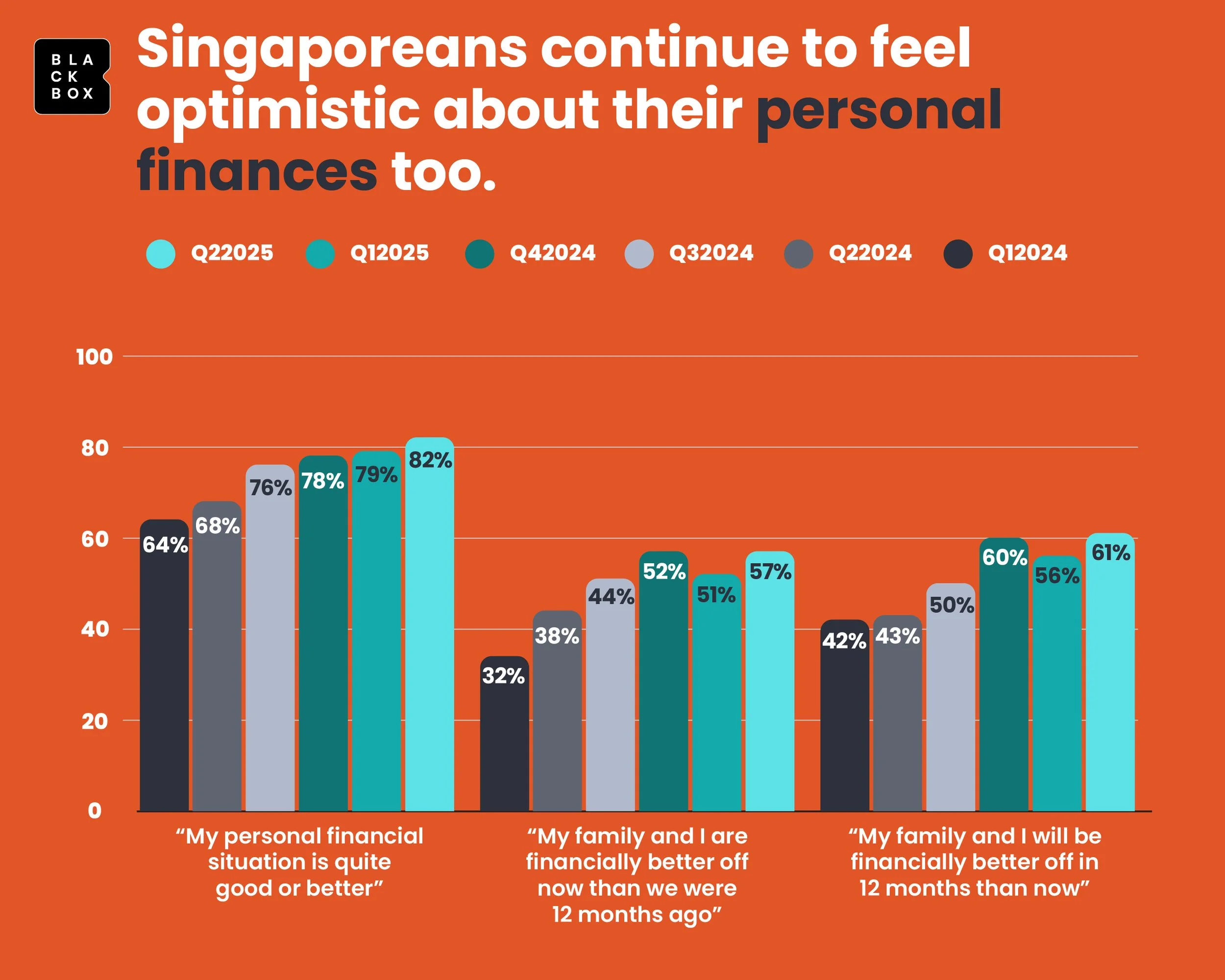

Personal Finances:

82% rate their current financial situation as “quite good” or better (+3pts). (This is a significant rise of +18pts more than 18 months ago, illustrating just how far personal finance sentiment has improved.)

57% feel better off now than a year ago (+6pts)

Among younger Singaporeans (under 30), 72% say they’re financially better off than last year

61% expect to be better off next year (+5pts)

Taken together, these numbers suggest a community that is starting to feel the effects of a stabilising economy, supported by policy certainty post-election and fiscal assistance timed to reduce pressure on households.

Decision Intelligence: What This Quarter’s Data Tells Us

The message from this quarter’s SensingSG data is clear: Singaporeans feel steady, grounded, and forward-looking at home — but are increasingly wary of what’s happening overseas.

As Trump’s policies begin to influence both public perception and actual consumer choices, the growing appeal of Chinese brands suggests that Asia’s balance of brand power may be starting to shift — not just at the diplomatic level, but at the dinner table, the checkout, and the browser tab.

Confidence is holding locally. But the world beyond Singapore’s borders feels more uncertain.

Blackbox is Asia’s leading provider of decision intelligence. Reach out to us to find out how our holistic range of market research solutions can help your organisation make decisions that matter.